Python API Client Walkthrough

Python API Client Walkthrough

Last Updated: Version 2024.08.20

This notebook demonstrates basic functionality offered by the Coin Metrics Python API Client using Coin Metrics Community Data.

Coin Metrics offers a vast assortment of data for hundreds of cryptoassets. The Python API Client allows for easy access to this data using Python without needing to create your own wrappers using requests and other such libraries.

Prerequisites

First, Python must be installed. Download and install from python.org. The Coin Metrics API Client is best used with Python 3.8 or later.

Then, install the Python API Client:

pip install coinmetrics-api-client

Some of the optional libraries such as pandas, numpy, and seaborn are used in the notebook to make the examples more interactive. These libraries are not required to use the Coin Metrics API Client.

You are now ready to run the code in the rest of the notebook.

Resources

To understand the data that Coin Metrics offers, feel free to peruse the resources below.

The Coin Metrics API v4 website contains the full set of endpoints and data offered by Coin Metrics.

The Coin Metrics Product Documentation gives detailed, conceptual explanations of the data that Coin Metrics offers.

The API Spec contains a full list of functions.

The Coverage Tool shows what assets, metrics, and other data types are covered.

Setup

Catalogs

The Coin Metrics API contains two types of catalog endpoints (Python client functions in paranthesis): the catalog (catalog_*_v2) and catalog-all (catalog_full_*_v2).

The catalog endpoint displays the set of data available to your API key. The catalog-all endpoint displays the full set of data for our dataset.

Catalog objects return a list of dictionaries. For catalog_asset_metrics_v2, each element of the list is an asset, while each dictionary is a set of metadata for that specific asset.

For more details on what metrics are covered, see Coverage

Getting Timeseries Data

Next, we will pull timeseries data. Typically there are two types of timeseries data that you can pull: raw observations such as trades and aggregated metrics. We will explore these two below.

Asset Metrics

First, we will use the asset-metrics endpoint to get metrics for BTC and ETH.

You can bound your query by time like below:

0

btc

2024-09-01 00:00:00+00:00

1132518348250.186279

58959.926273

1

btc

2024-09-02 00:00:00+00:00

1168286956855.852539

57349.080718

2

btc

2024-09-03 00:00:00+00:00

1138274882375.744873

59159.023888

3

btc

2024-09-04 00:00:00+00:00

1146114653782.878418

57637.775444

4

btc

2024-09-05 00:00:00+00:00

1108213762229.152832

58033.39897

0

btc

2024-08-15 00:00:00+00:00

1137894996787.05249

58840.64668

1

btc

2024-08-16 00:00:00+00:00

1163252605521.227783

57644.187688

2

btc

2024-08-17 00:00:00+00:00

1172900035803.550781

58927.276509

3

btc

2024-08-18 00:00:00+00:00

1160659435495.434814

59414.674335

4

btc

2024-08-19 00:00:00+00:00

1172894781992.733887

58793.206146

Coin Metrics supports several metrics for various data types such as exchanges, markets, and asset-pairs.

You can also bound your queries by using the limit parameter.

0

btc

2024-09-01 00:00:00+00:00

660770

9283

3046587

20365534

973

1

btc

2024-09-02 00:00:00+00:00

717673

9284

3046904

20359814

972

2

eth

2024-09-01 00:00:00+00:00

548611

6907

1836310

27996184

1221

3

eth

2024-09-02 00:00:00+00:00

488354

6902

1836617

28008369

1218

0

btc

2024-08-15 00:00:00+00:00

715632

9229

3054724

20292616

973

1

btc

2024-08-16 00:00:00+00:00

700335

9231

3055010

20300505

977

2

eth

2024-08-15 00:00:00+00:00

603353

6862

1837926

27972812

1226

3

eth

2024-08-16 00:00:00+00:00

541263

6871

1837366

27962507

1223

Market Observations

The other common timeseries data type that you will encounter are individual observations.

First, we will need to familiarize ourselves with the market convention which we can find on faqs. You can see a full list of markets by using the reference-data endpoint.

0

coinbase-1inch-btc-spot

coinbase

1inch

btc

1inch-btc

1INCH-BTC

spot

<NA>

<NA>

<NA>

...

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

<NA>

<NA>

1

coinbase-aave-btc-spot

coinbase

aave

btc

aave-btc

AAVE-BTC

spot

<NA>

<NA>

<NA>

...

0.000001

0.000001

<NA>

0.000016

<NA>

<NA>

False

<NA>

<NA>

<NA>

2

coinbase-ada-btc-spot

coinbase

ada

btc

ada-btc

ADA-BTC

spot

<NA>

<NA>

<NA>

...

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

<NA>

<NA>

3

coinbase-algo-btc-spot

coinbase

algo

btc

algo-btc

ALGO-BTC

spot

<NA>

<NA>

<NA>

...

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

<NA>

<NA>

4

coinbase-ankr-btc-spot

coinbase

ankr

btc

ankr-btc

ANKR-BTC

spot

<NA>

<NA>

<NA>

...

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

<NA>

<NA>

5 rows × 39 columns

0

coinbase-1inch-btc-spot

coinbase

1inch

btc

1inch-btc

1INCH-BTC

spot

<NA>

<NA>

<NA>

...

<NA>

<NA>

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

1

coinbase-aave-btc-spot

coinbase

aave

btc

aave-btc

AAVE-BTC

spot

<NA>

<NA>

<NA>

...

<NA>

<NA>

0.000001

0.000001

<NA>

0.000016

<NA>

<NA>

False

<NA>

2

coinbase-ada-btc-spot

coinbase

ada

btc

ada-btc

ADA-BTC

spot

<NA>

<NA>

<NA>

...

<NA>

<NA>

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

3

coinbase-algo-btc-spot

coinbase

algo

btc

algo-btc

ALGO-BTC

spot

<NA>

<NA>

<NA>

...

<NA>

<NA>

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

4

coinbase-ankr-btc-spot

coinbase

ankr

btc

ankr-btc

ANKR-BTC

spot

<NA>

<NA>

<NA>

...

<NA>

<NA>

0.0

0.0

<NA>

0.000016

<NA>

<NA>

False

<NA>

5 rows × 37 columns

We can then pass these markets onto the timeseries/market-* endpoints. Below is an example of how to pull individual market trades.

0

coinbase-btc-usd-spot

2024-10-25 15:22:44.919441+00:00

705966854

0.000004

68353.27

2024-10-25 15:22:45.721609+00:00

buy

1

coinbase-btc-usd-spot

2024-10-25 15:22:44.919441+00:00

705966855

0.000012

68353.27

2024-10-25 15:22:45.721609+00:00

buy

2

coinbase-btc-usd-spot

2024-10-25 15:22:44.919441+00:00

705966856

0.002187

68354.37

2024-10-25 15:22:45.721609+00:00

buy

3

coinbase-btc-usd-spot

2024-10-25 15:22:44.919441+00:00

705966857

0.002523

68354.38

2024-10-25 15:22:45.721609+00:00

buy

4

coinbase-btc-usd-spot

2024-10-25 15:22:45.078614+00:00

705966858

0.001043

68353.27

2024-10-25 15:22:45.721609+00:00

buy

0

coinbase-btc-usd-spot

2024-09-13 16:55:02.663733+00:00

691698441

0.008

59491.6

2024-09-13 16:55:03.253369+00:00

sell

1

coinbase-btc-usd-spot

2024-09-13 16:55:02.670644+00:00

691698442

0.008

59491.61

2024-09-13 16:55:03.253369+00:00

buy

2

coinbase-btc-usd-spot

2024-09-13 16:55:03.057923+00:00

691698443

0.001186

59491.61

2024-09-13 16:55:03.771512+00:00

buy

3

coinbase-btc-usd-spot

2024-09-13 16:55:03.143752+00:00

691698444

0.15742

59491.6

2024-09-13 16:55:03.771512+00:00

sell

4

coinbase-btc-usd-spot

2024-09-13 16:55:03.143816+00:00

691698445

0.076281

59491.6

2024-09-13 16:55:03.771512+00:00

sell

Examples from State of the Network

The Python API Client is often used for transforming data for State of the Network. Below are some examples of data transformations done to produce the data visualizations.

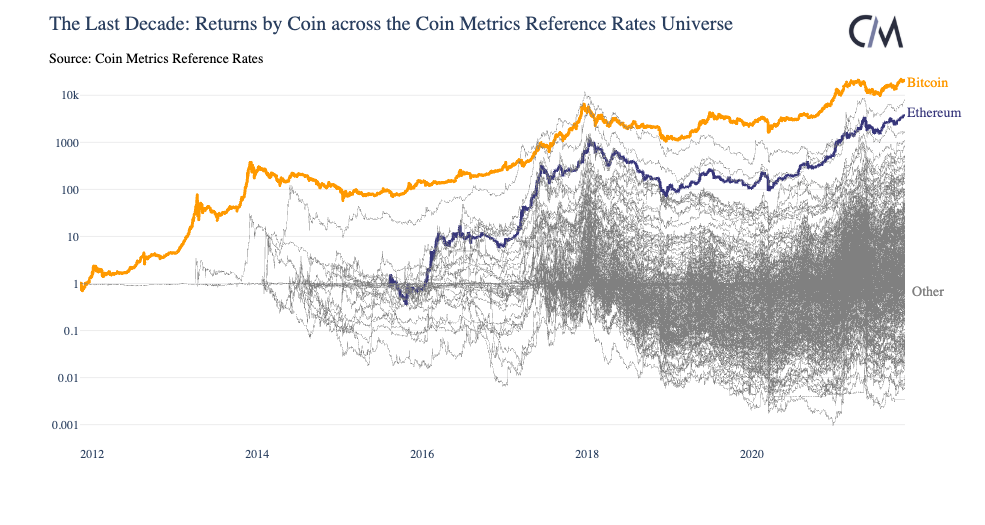

Example 1: Get returns by coin in the CM reference rates universe over the last 10-years

In State of the Network #128, we looked at the returns for each asset dating back the last 10 years.

We can generate this data by weaving in the catalog_asset_metrics_v2 and get_asset_metrics endpoint. The code snippets below demonstrate how to do this with a small list of assets.

time

2024-09-26 00:00:00+00:00

1.102137

1.100617

1.069534

1.070347

1.024427

1.030510

2024-09-27 00:00:00+00:00

1.162204

1.118540

1.103424

1.164025

1.046276

1.042040

2024-09-28 00:00:00+00:00

1.165724

1.141772

1.115465

1.222446

1.073526

1.040046

2024-09-29 00:00:00+00:00

1.158667

1.127693

1.115512

1.267128

1.064176

1.084632

2024-09-30 00:00:00+00:00

1.151477

1.119118

1.112921

1.232789

1.056856

1.133519

time

2024-09-09 00:00:00+00:00

1.008826

0.960197

0.932336

0.936040

0.862489

0.930312

2024-09-10 00:00:00+00:00

1.024744

0.990748

0.971026

1.011867

0.885729

0.948722

2024-09-11 00:00:00+00:00

1.024288

0.988299

0.980011

1.001351

0.896031

0.950876

2024-09-12 00:00:00+00:00

1.051865

1.011061

0.975672

0.987734

0.878328

0.940610

2024-09-13 00:00:00+00:00

1.061901

1.036981

0.987831

1.001874

0.885837

0.987858

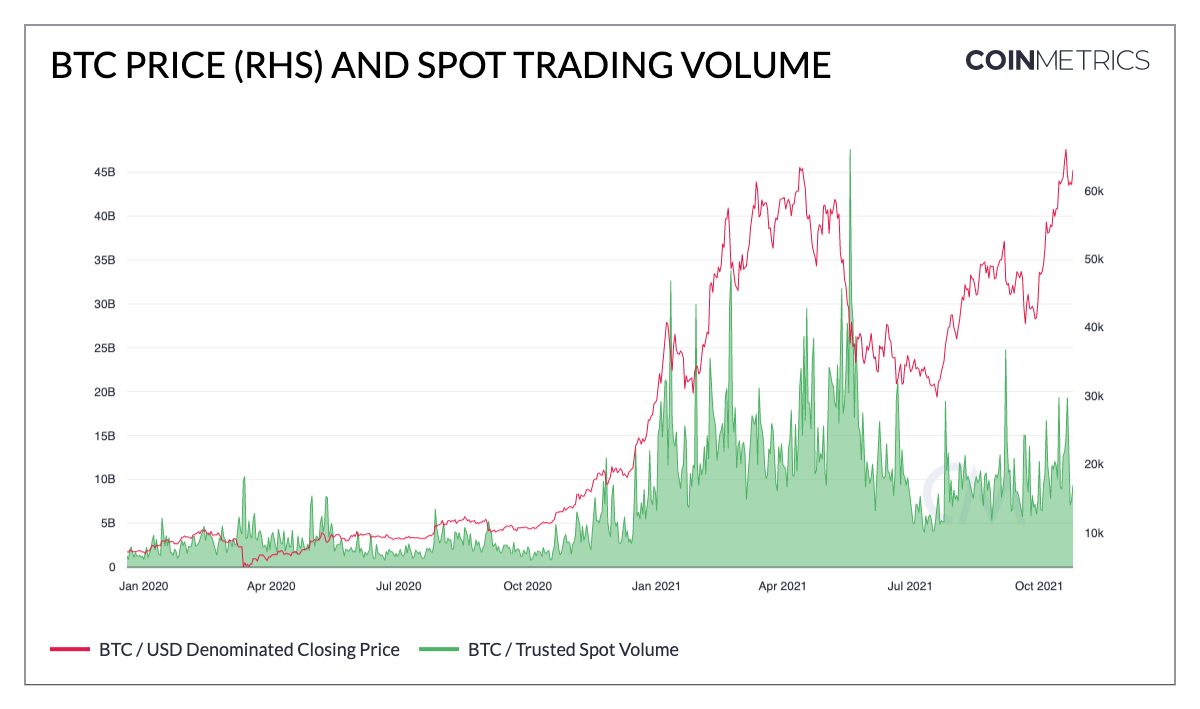

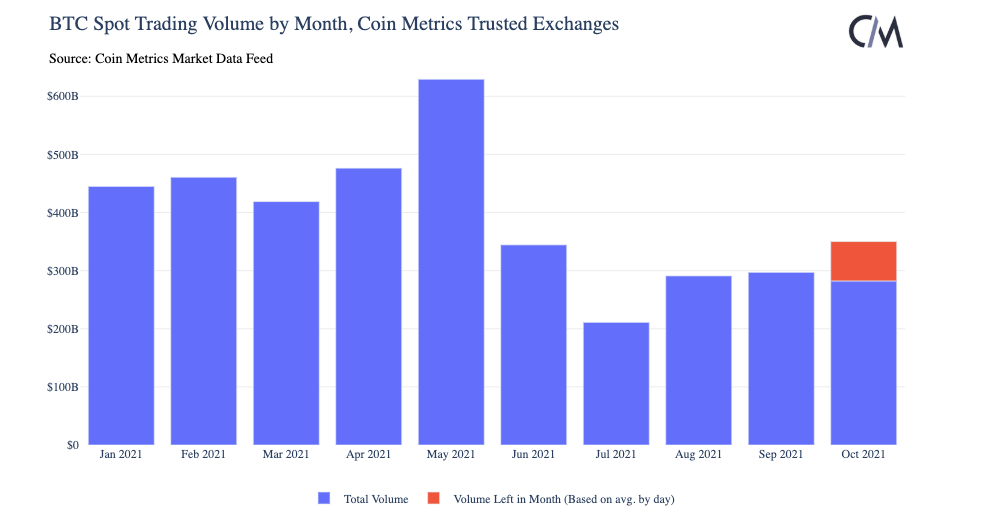

Example 2: Get daily spot trading volume on Coinbase for USDC markets

In State of the Network #126, we looked at spot volume on trusted exchanges over time.

We can replicate similar data behind chart using just coinbase spot markets at 2021. Here, we derive volume from our get_market_candles endpoint.

0

coinbase-eurc-usdc-spot

2024-08-23 00:00:00+00:00

1.121

1.119

1.121

1.118

1.120121

997787.0

1.117636e+06

140

1

coinbase-eurc-usdc-spot

2024-08-24 00:00:00+00:00

1.12

1.12

1.13

1.119

1.120547

1122215.0

1.257359e+06

412

2

coinbase-eurc-usdc-spot

2024-08-25 00:00:00+00:00

1.121

1.12

1.132

1.119

1.121433

2796276.0

3.135467e+06

1727

3

coinbase-eurc-usdc-spot

2024-08-26 00:00:00+00:00

1.12

1.118

1.126

1.116

1.118883

1999004.0

2.236406e+06

882

4

coinbase-eurc-usdc-spot

2024-08-27 00:00:00+00:00

1.117

1.119

1.122

1.116

1.118849

1505368.0

1.684066e+06

1227

0

coinbase-eurc-usdc-spot

2024-08-23 00:00:00+00:00

1.121

1.119

1.121

1.118

1.120121

997787.0

1.117636e+06

140

1

coinbase-eurc-usdc-spot

2024-08-24 00:00:00+00:00

1.12

1.12

1.13

1.119

1.120547

1122215.0

1.257357e+06

412

2

coinbase-eurc-usdc-spot

2024-08-25 00:00:00+00:00

1.121

1.12

1.132

1.119

1.121433

2796276.0

3.135472e+06

1727

3

coinbase-eurc-usdc-spot

2024-08-26 00:00:00+00:00

1.12

1.118

1.126

1.116

1.118883

1999004.0

2.236419e+06

882

4

coinbase-eurc-usdc-spot

2024-08-27 00:00:00+00:00

1.117

1.119

1.122

1.116

1.118849

1505368.0

1.684074e+06

1227

We can also break this down by month. Note that for this example, the volume numbers will look smaller because we are using fewer exchanges.

time

January

4.401994e+08

February

1.227417e+08

March

2.522828e+08

April

1.476761e+08

May

2.575348e+08

June

9.312749e+08

July

1.331209e+09

August

2.433962e+09

September

1.849214e+09

Last updated

Was this helpful?